Time Series Analysis using iPython

Note: I am not as expert in time-series analysis as I am in other areas of Analytics, so if you find errors I would be happy to know about them and correct them.

Introduction

ARIMA models are, in theory, the most general class of models for forecasting a time series, which can be made to be “stationary” by differencing (if necessary), perhaps in conjunction with nonlinear transformations such as logging or deflating (if necessary). A random variable that is a time series is stationary if its statistical properties are all constant over time. A stationary series has no trend, its variations around its mean have a constant amplitude, and it wiggles in a consistent fashion, i.e., its short-term random time patterns always look the same in a statistical sense. The latter condition means that its autocorrelations (correlations with its prior deviations from the mean) remain constant over time, or equivalently, that its power spectrum remains constant over time. A random variable of this form can be viewed (as usual) as a combination of signal and noise, and the signal (if one is apparent) could be a pattern of fast or slow mean reversion, or sinusoidal oscillation, or rapid alternation in sign, and it could also have a seasonal component. An ARIMA model can be viewed as a “filter” that tries to separate the signal from the noise, and the signal is then extrapolated into the future to obtain forecasts.

The Data

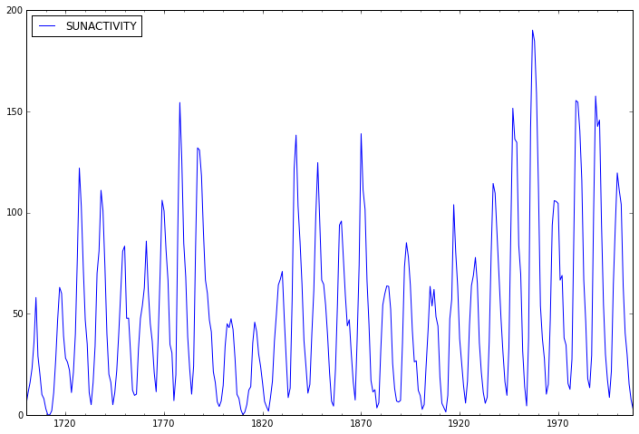

The data we will use is annual sunspot data from 1700 – 2008 recording the number of sunspots per year. The file sunspots.csv and can be downloaded from the line below.

Import Packages

In addition to Statsmodels, we will need to import additional packages, including Numpy, Scipy, Pandas, and Matplotlib.

Also, from Statsmodels we will need to import qqplot.

In [1]:

import numpy as np

from scipy import stats

import pandas as pd

import matplotlib.pyplot as plt

import statsmodels.api as sm

In [2]:

from statsmodels.graphics.api import qqplot

Loading the Dataset

We will use pandas to load the .csv file which we downloaded earlier.

In [3]:

dta= pd.read_csv("C:/Users/Strickland/Documents/Python Scripts/sunspots.csv")

Check the Data Upload

Next we check to see that the data uploaded correctly by viewing the dataset Notes.

In [4]:

print sm.datasets.sunspots.NOTE

Preparing the Data

Next we need to do a little dataset preparation. Here, an annual date series must be date-times at the end of the year.

In [5]:

dta.index = pd.Index(sm.tsa.datetools.dates_from_range('1700', '2008'))

del dta["YEAR"]

Examine the Data

Now we take a look at the data.

In [6]:

# show plots in the notebook

%matplotlib inline

dta.plot(figsize=(12,8));

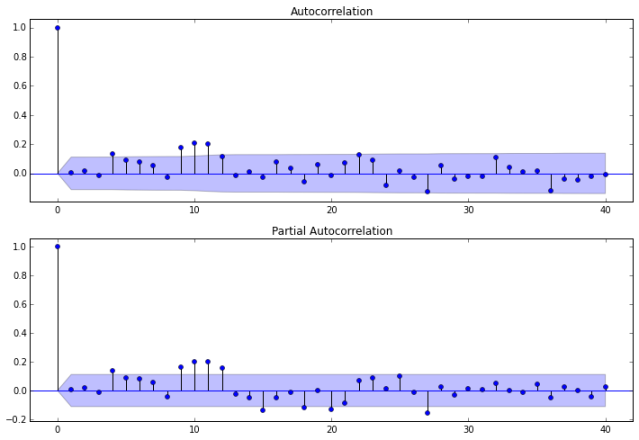

Auto-correlations

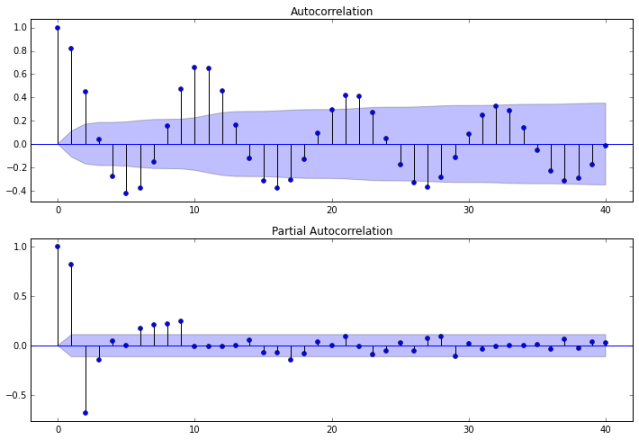

Before we decide which model to use, we need to look at auto-correlations.

Autocorrelation correlogram. Seasonal patterns of time series can be examined via correlograms, which display graphically and numerically the autocorrelation function (ACF). Auto-correlation in pandas plotting and statsmodels graphics standardize the data before computing the auto-correlation. These libraries subtract the mean and divide by the standard deviation of the data.

When using standardization, they make an assumption that your data has been generated with a Gaussian law (with a certain mean and standard deviation). This may not be the case in reality.

Correlation is sensitive. Both (matplotlib and pandas plotting) of these functions have their drawbacks. The figure generated by the following code using matplotlib will be identical to figure generated by pandas plotting or statsmodels graphics.

Partial autocorrelations. Another useful method to examine serial dependencies is to examine the partial autocorrelation function (PACF) – an extension of autocorrelation, where the dependence on the intermediate elements (those within the lag) is removed.

Once we determine the nature of the auto-correlations we use the following rules of thumb.

- Rule 1: If the ACF shows exponential decay, the PACF has a spike at lag 1, and no correlation for other lags, then use one autoregressive (p)parameter

- Rule 2: If the ACF shows a sine-wave shape pattern or a set of exponential decays, the PACF has spikes at lags 1 and 2, and no correlation for other lags, the use two autoregressive (p) parameters

- Rule 3: If the ACF has a spike at lag 1, no correlation for other lags, and the PACF damps out exponentially, then use one moving average (q) parameter.

- Rule 4: If the ACF has spikes at lags 1 and 2, no correlation for other lags, and the PACF has a sine-wave shape pattern or a set of exponential decays, then use two moving average (q) parameter.

- Rule 5: If the ACF shows exponential decay starting at lag 1, and the PACF shows exponential decay starting at lag 1, then use one autoregressive (p) and one moving average (q) parameter.

Removing serial dependency. Serial dependency for a particular lag can be removed by differencing the series. There are two major reasons for such transformations.

- First, we can identify the hidden nature of seasonal dependencies in the series. Autocorrelations for consecutive lags are interdependent, so removing some of the autocorrelations will change other auto correlations, making other seasonalities more apparent.

- Second, removing serial dependencies will make the series stationary, which is necessary for ARIMA and other techniques.

Another popular test for serial correlation is the Durbin-Watson statistic. The DW statistic will lie in the 0-4 range, with a value near two indicating no first-order serial correlation. Positive serial correlation is associated with DW values below 2 and negative serial correlation with DW values above 2.

In [7]:

sm.stats.durbin_watson(dta)

Out[7]:

The value of Durbin-Watson statistic is close to 2 if the errors are uncorrelated. In our example, it is 0.1395. That means that there is a strong evidence that the variable open has high autocorrelation.

In [8]:

# show plots in the notebook

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(dta.values.squeeze(), lags=40, ax=ax1)

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(dta, lags=40, ax=ax2)

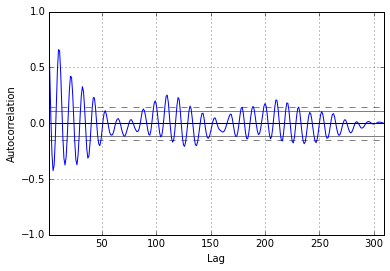

The plots also indicate that autocorrelation is present. Another set of plots (shown below) are available using the autocorrelation_plot function from Pandas.

In [9]:

from pandas.tools.plotting import autocorrelation_plot

In [10]:

# show plots in the notebook

%matplotlib inline

dta['SUNACTIVITY_2'] = dta['SUNACTIVITY']

dta['SUNACTIVITY_2'] = (dta['SUNACTIVITY_2'] - dta['SUNACTIVITY_2'].mean()) / (dta['SUNACTIVITY_2'].std())

plt.acorr(dta['SUNACTIVITY_2'],maxlags = len(dta['SUNACTIVITY_2']) -1, linestyle = "solid", usevlines = False, marker='')

plt.show()

autocorrelation_plot(dta['SUNACTIVITY'])

plt.show()

For mixed ARMA processes the Autocorrelation function is a mixture of exponentials and damped sine waves after (q-p) lags. The partial autocorrelation function is a mixture of exponentials and dampened sine waves after (p-q) lags.

Times Series Modeling

We will only explore two methods here. An ARMA model is classified as ARMA(p,q), with no differenceing terms. ARMA models can be described by a series of equations. The equations are somewhat simpler if the time series is first reduced to zero-mean by subtracting the sample mean. Therefore, we will work with the mean-adjusted series

yt; = Yt – Y̅, t = 1, …N

where Yt is the original time series, Y̅ is its sample mean, and yt is the mean-adjusted series. One subset of ARMA models are the so-called autoregressive, or AR models. An AR model expresses a time series as a linear function of its past values. The order of the AR model tells how many lagged past values are included. The simplest AR model is the first-order autoregressive, or AR(1), model

yt + a1 yt-1 = et

where yt is the mean-adjusted series in year t, yt-1 is the series in the previous year, at is the lag-1 autoregressive coefficient, and et is the noise. The noise also goes by various other names: the error, the random-shock, and the residual. The residuals et are assumed to be random in time (not autocorrelated), and normally distributed. Be rewriting the equation for the AR(1) model as

yt = a1 yt-1 + et

We see that the AR(1) model has the form of a regression model in which yt is regressed on its previous value. In this form, at is analogous to the negative of the regression coefficient, and et to the regression residuals. The name autoregressive refers to the regression on self (auto).

A nonseasonal ARIMA model is classified as an ARIMA(p,d,q) model, where:

- p is the number of autoregressive terms,

- d is the number of nonseasonal differences needed for stationarity, and

- q is the number of lagged forecast errors in the prediction equation.

The forecasting equation is constructed as follows. First, let y denote the dth difference of Y, which means:

If d=0: yt = Yt

If d=1: yt = Yt – Yt-1

If d=2: yt = (Yt – Yt-1) – (Yt-1 – Yt-2) = Yt – 2Yt-1 + Yt-2

Note that the second difference of Y (the d=2 case) is not the difference from two periods ago. Rather, it is the first-difference-of-the-first difference, which is the discrete analog of a second derivative, i.e., the local acceleration of the series rather than its local trend.

Modeling the Data

Model One: ARMA(2,0)

Using Rule 2 from above, we will first try an ARMA(2,0) model with two autoregressive terms and no moving averages.

In [11]:

arma_mod20 = sm.tsa.ARMA(dta, (2,0)).fit()

print arma_mod20.params

We now calculate the Akaike Information Criterion (AIC), Schwarz Bayesian Information Criterion (BIC), and Hannan-Quinn Information Criterion (HQIC). Our goalis to choose a model that minimizes (AIC, BIC, HQIC).

In [12]:

print arma_mod20.aic, arma_mod20.bic, arma_mod20.hqic

Does our model obey the theory? We will use the Durbin-Watson test for autocorrelation. The Durbin-Watson statistic ranges in value from 0 to 4. A value near 2 indicates non-autocorrelation; a value toward 0 indicates positive autocorrelation; a value toward 4 indicates negative autocorrelation.

In [13]:

sm.stats.durbin_watson(arma_mod20.resid.values)

Out[13]:

The Durbin-Watson test shows no autocorrelation.

Plotting the Data

Next we plot and study the data it represents.

In [14]:

# show plots in the notebook

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

ax = arma_mod20.resid.plot(ax=ax);

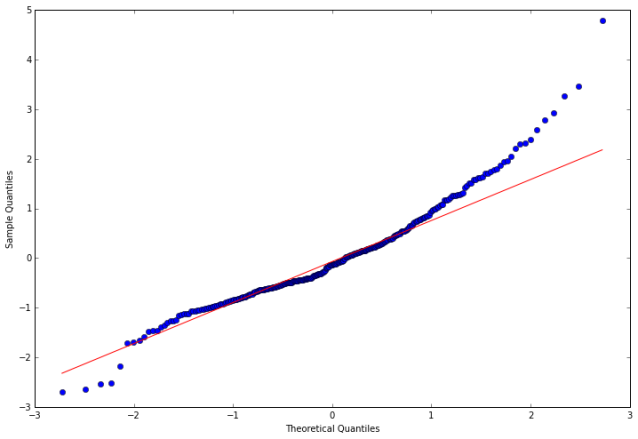

Analyzing the Residuals

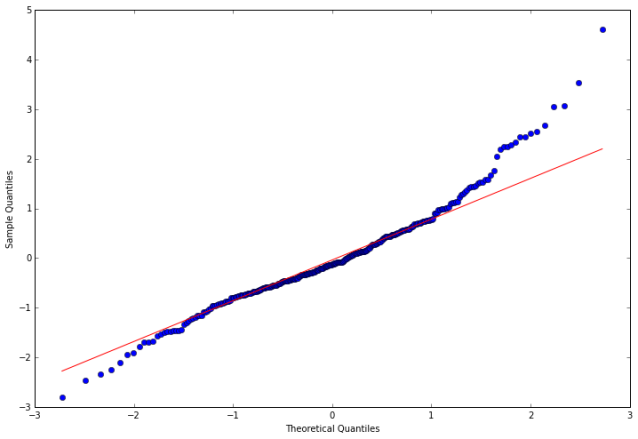

In the following steps, we calculate the residuals, tests the null hypothesis that the residuals come from a normal distribution, and construct a qq-plot.

In [15]:

resid20 = arma_mod20.resid

In [16]:

stats.normaltest(resid20)

Out[16]:

In [17]:

# show plots in the notebook

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

fig = qqplot(resid20, line='q', ax=ax, fit=True)

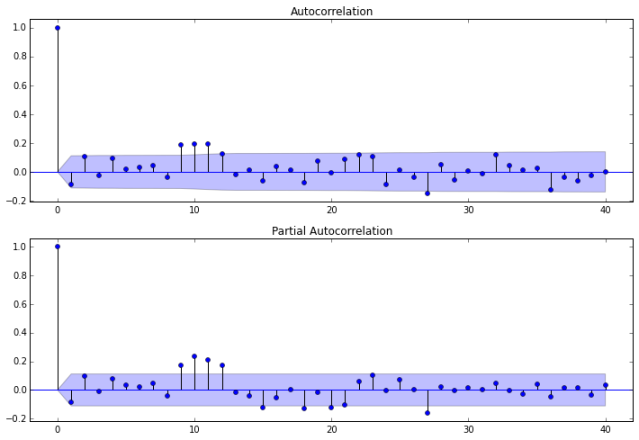

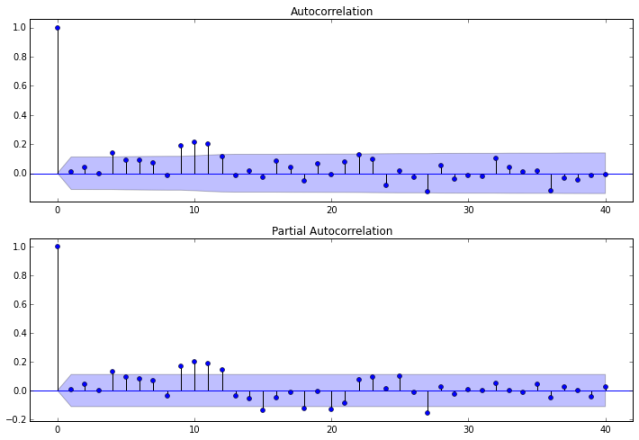

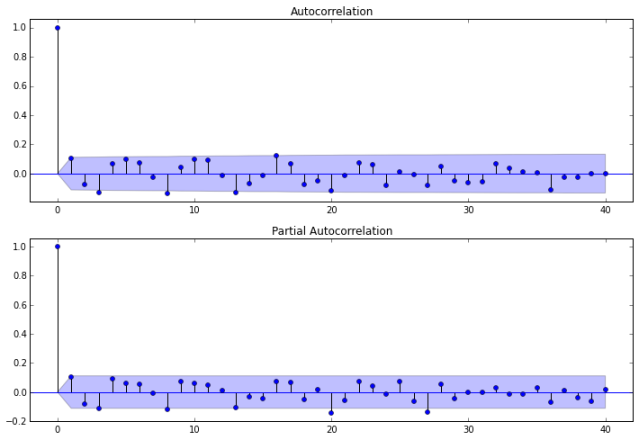

Model Autocorrelation

Now we investigate the autocorrelation of our ARMA(2,0) model.

In [18]:

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(resid20.values.squeeze(), lags=40, ax=ax1)

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(resid20, lags=40, ax=ax2)

Next, we calculate the lag, autocorrelation (AC), Q statistic and Prob>Q. The Ljung–Box Q test (named for Greta M. Ljung and George E. P. Box) is a type of statistical test of whether any of a group of autocorrelations of a time series are different from zero. The null hypothesis is, H0: The data are independently distributed (i.e. the correlations in the population from which the sample is taken are 0, so that any observed correlations in the data result from randomness of the sampling process).

In [19]:

r,q,p = sm.tsa.acf(resid20.values.squeeze(), qstat=True)

data = np.c_[range(1,41), r[1:], q, p]

table = pd.DataFrame(data, columns=['lag', "AC", "Q", "Prob(>Q)"])

print table.set_index('lag')

Notice that the p-values for the Ljung–Box Q test all are well above .05 for lags 1 through 8, indicating “significance.” This is not a desirable result. However, the p-values for the remaining lags through 40 data values as less than .05. So there is much data not contributing to correlations at high lags.

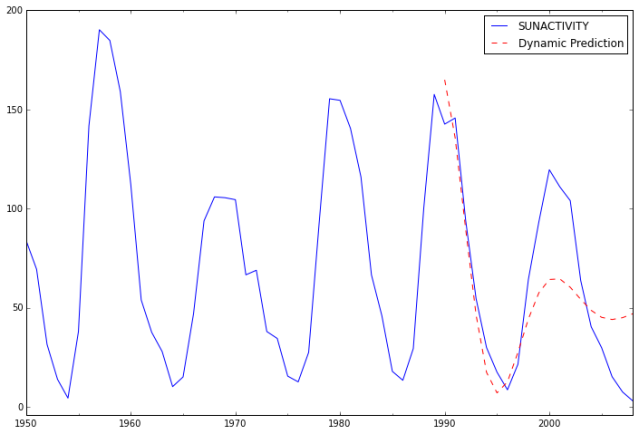

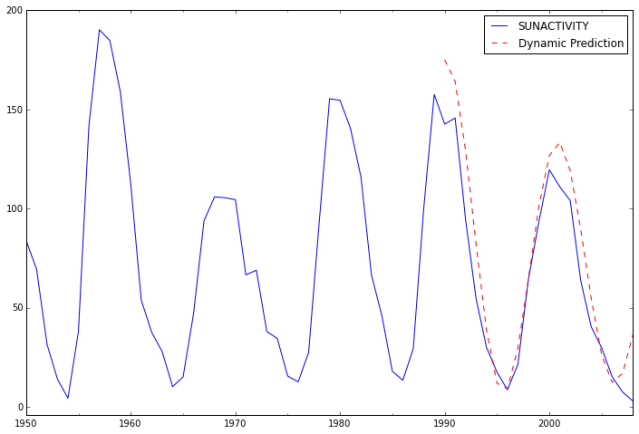

Predictions

Next, we compute the predictions and analyze their fit against actual values.

In [20]:

predict_sunspots20 = arma_mod20.predict('1990', '2012', dynamic=True)

print predict_sunspots20

In [21]:

ax = dta.ix['1950':].plot(figsize=(12,8))

ax = predict_sunspots20.plot(ax=ax, style='r--', label='Dynamic Prediction');

ax.legend();

ax.axis((-20.0, 38.0, -4.0, 200.0));

The fit looks good up to about 1998 and underfit the data afterwards.

Calculate Forecast Errors

Mean absolute error: The mean absolute error (MAE) value is computed as the average absolute error value. If this value is 0 (zero), the fit (forecast) is perfect. As compared to the mean squared error value, this measure of fit will “de-emphasize” outliers, that is, unique or rare large error values will affect the MAE less than the MSE value.

Mean Forecast Error (Bias). The mean forecast error (MFE) is the average error in the observations. A large positive MFE means that the forecast is undershooting the actual observations, and a large negative MFE means the forecast is overshooting the actual observations. A value near zero is ideal.

The MAE is a better indicator of fit than the MFE.

In [22]:

def mean_forecast_err(y, yhat):

return y.sub(yhat).mean()

In [23]:

def mean_absolute_err(y, yhat):

return np.mean((np.abs(y.sub(yhat).mean()) / yhat)) # or percent error = * 100

In [24]:

print "MFE = ", mean_forecast_err(dta.SUNACTIVITY, predict_sunspots20)

print "MAE = ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots20)

For MFE > 0, models tends to under-forecast. However, as long as the tracking signal is between –4 and 4, we assume the model is working correctly. The measure of MAE being small would indicate a pretty good fit.

Model Two: ARMA(3,0)

As a second model, we will try an ARMA(3,0) model with three autoregressive terms and no moving averages.

In [25]:

arma_mod30 = sm.tsa.ARMA(dta, (3,0)).fit()

In [26]:

print arma_mod30.params

In [27]:

print arma_mod30.aic, arma_mod30.bic, arma_mod30.hqic

Does our model obey the theory?

In [28]:

sm.stats.durbin_watson(arma_mod30.resid.values)

Out[28]:

The Durbin-Watson is lose to 2, so the test shows very little if any positive autocorrelation.

In [29]:

# show plots in the notebook

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

ax = arma_mod30.resid.plot(ax=ax);

In [30]:

resid30 = arma_mod30.resid

In [31]:

stats.normaltest(resid30)

Out[31]:

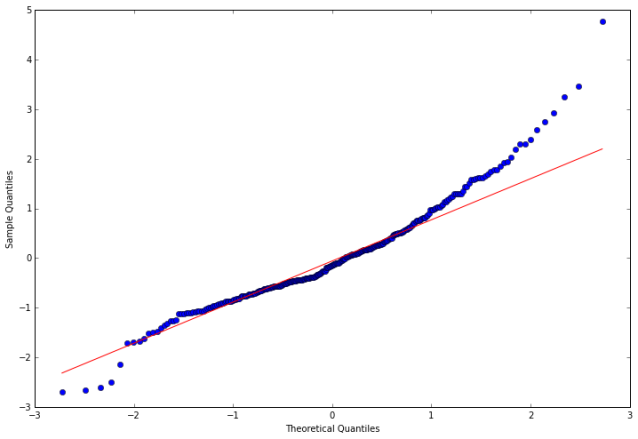

In [32]:

# show plots in the notebook

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

fig = qqplot(resid30, line='q', ax=ax, fit=True)

In [33]:

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(resid30.values.squeeze(), lags=40, ax=ax1)

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(resid30, lags=40, ax=ax2)

In [34]:

r,q,p = sm.tsa.acf(resid30.values.squeeze(), qstat=True)

data = np.c_[range(1,41), r[1:], q, p]

table = pd.DataFrame(data, columns=['lag', "AC", "Q", "Prob(>Q)"])

print table.set_index('lag')

This could indicate a lack of fit. Notice that the p-values for the Ljung–Box Q test all are well above 0.05 for lags 1 through 8, indicating “significance.” This is not a desirable result. However, the p-values for the remaining lags through 40 data values as less than 0.05. So there is much data not contributing to correlations at high lags.

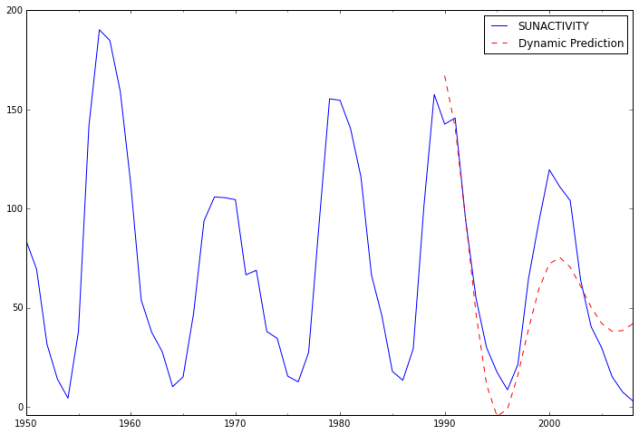

In-sample dynamic prediction. How well does our model do?

In [35]:

predict_sunspots30 = arma_mod30.predict('1990', '2012', dynamic=True)

print predict_sunspots30

In [36]:

ax = dta.ix['1950':].plot(figsize=(12,8))

ax = predict_sunspots30.plot(ax=ax, style='r--', label='Dynamic Prediction');

ax.legend();

ax.axis((-20.0, 38.0, -4.0, 200.0));

In [37]:

print "MFE = ", mean_forecast_err(dta.SUNACTIVITY, predict_sunspots30)

print "MAE = ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots30)

For small MAE the model is a pretty good fit. The MFE being slightly above 4 might indicate the model tends to under-forecast.

Model Three: ARMA(2,1)

As a third model, we will try an ARMA(2,1) model with two autoregressive terms and one moving average term.

In [38]:

arma_mod40 = sm.tsa.ARMA(dta, (2,1)).fit()

In [39]:

res40 = arma_mod40.resid

In [40]:

print arma_mod40.params

In [41]:

print arma_mod40.aic, arma_mod40.bic, arma_mod40.hqic

In [42]:

sm.stats.durbin_watson(arma_mod40.resid.values)

Out[42]:

In [43]:

predict_sunspots40 = arma_mod40.predict('1990', '2012', dynamic=True)

In [44]:

resid40 = arma_mod40.resid

In [45]:

stats.normaltest(resid40)

Out[45]:

In [46]:

predict_sunspots40 = arma_mod40.predict('1990', '2012', dynamic=True)

In [47]:

print "Metric for ARMA(2,1): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots40),"MFE"

In [48]:

print "Metric for ARMA(2,1): ",mean_absolute_err(dta.SUNACTIVITY, predict_sunspots40),"MAE"

Model Four: ARMA(2,3)

As a fourth model we will try an ARMA(2,3) model with three autoregressive terms and two moving averages.

In [49]:

arma_mod50 = sm.tsa.ARMA(dta, (2,3)).fit()

In [50]:

sm.stats.durbin_watson(arma_mod50.resid.values)

Out[50]:

In [51]:

print arma_mod50.params

In [52]:

print arma_mod50.aic, arma_mod50.bic, arma_mod50.hqic

In [53]:

resid50 = arma_mod50.resid

In [54]:

stats.normaltest(resid50)

Out[54]:

In [55]:

predict_sunspots50 = arma_mod50.predict('1990', '2012', dynamic=True)

In [56]:

ax = dta.ix['1950':].plot(figsize=(12,8))

ax = predict_sunspots50.plot(ax=ax, style='r--', label='Dynamic Prediction');

ax.legend();

ax.axis((-20.0, 38.0, -4.0, 200.0));

In [57]:

print "Metric for ARMA(3,2): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots50),"MLE"

In [58]:

print "Metric for ARMA(3,2): ",mean_absolute_err(dta.SUNACTIVITY, predict_sunspots50),"MAE"

Model Five: ARIMA(3,0,2)

As a fifth model we will try an AIMA(3,0,2) model with three autoregressive terms, no differences, and two moving averages.

In [59]:

arima_mod1 = sm.tsa.ARIMA(dta, (3,0,2)).fit()

In [60]:

print arima_mod1.params

In [61]:

sm.stats.durbin_watson(arima_mod1.resid.values)

Out[61]:

In [62]:

print arima_mod1.aic, arima_mod1.bic, arima_mod1.hqic

In [63]:

# show plots in the notebook

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

ax = arima_mod1.resid.plot(ax=ax);

In [64]:

resid1 = arima_mod1.resid

In [65]:

stats.normaltest(resid1)

Out[65]:

In [66]:

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

fig = qqplot(resid1, line='q', ax=ax, fit=True)

In [67]:

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(resid1.values.squeeze(), lags=40, ax=ax1)

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(resid1, lags=40, ax=ax2)

In [68]:

r,q,p = sm.tsa.acf(resid1.values.squeeze(), qstat=True)

data = np.c_[range(1,41), r[1:], q, p]

table = pd.DataFrame(data, columns=['lag', "AC", "Q", "Prob(>Q)"])

print table.set_index('lag')

In [69]:

predict_sunspots1 = arima_mod1.predict('1990', '2012', dynamic=True)

print predict_sunspots1

In [70]:

ax = dta.ix['1950':].plot(figsize=(12,8))

ax = predict_sunspots1.plot(ax=ax, style='r--', label='Dynamic Prediction');

ax.legend();

ax.axis((-20.0, 38.0, -4.0, 200.0));

In [71]:

print "Metrics for ARIMA(3,0,2): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots1),"MLE"

In [72]:

print "Metrics for ARIMA(3,0,2): ",mean_absolute_err(dta.SUNACTIVITY, predict_sunspots1),"MAE"

Model Six: ARIMA(2,0,3)

Now let’s examine a sixth model.

In [73]:

arima_mod2 = sm.tsa.ARIMA(dta, (2,0,3)).fit()

In [74]:

print arima_mod2.params

In [75]:

mean_forecast_err(dta.SUNACTIVITY, predict_sunspots30)

Out[75]:

In [76]:

print arima_mod2.aic, arima_mod2.bic, arima_mod2.hqic

In [77]:

# show plots in the notebook

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

ax = arima_mod2.resid.plot(ax=ax);

In [78]:

resid2 = arima_mod2.resid

In [79]:

stats.normaltest(resid2)

Out[79]:

In [80]:

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax = fig.add_subplot(111)

fig = qqplot(resid2, line='q', ax=ax, fit=True)

In [81]:

%matplotlib inline

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(resid2.values.squeeze(), lags=40, ax=ax1)

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(resid2, lags=40, ax=ax2)

In [82]:

r,q,p = sm.tsa.acf(resid2.values.squeeze(), qstat=True)

data = np.c_[range(1,41), r[1:], q, p]

table = pd.DataFrame(data, columns=['lag', "AC", "Q", "Prob(>Q)"])

print table.set_index('lag')

In [83]:

predict_sunspots2 = arima_mod2.predict('1990', '2012', dynamic=True)

print predict_sunspots2

In [84]:

print "Metrics for ARIMA(2,0,3): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots2),"MLE"

In [85]:

print "Metrics for ARIMA(2,0,3): ",mean_absolute_err(dta.SUNACTIVITY, predict_sunspots2),"MAE"

In [86]:

ax = dta.ix['1950':].plot(figsize=(12,8))

ax = predict_sunspots2.plot(ax=ax, style='r--', label='Dynamic Prediction');

ax.legend();

ax.axis((-20.0, 38.0, -4.0, 200.0));

Now let’s compare all six ARMA models using the metrics we have discussed.

In [87]:

print "Model 1: ARMA(2,0) AIC", arma_mod20.aic, " BIC", arma_mod20.bic, " HQIC", arma_mod20.hqic

print "Model 2: ARMA(3,0) AIC", arma_mod30.aic, " BIC", arma_mod30.bic, " HQIC", arma_mod30.hqic

print "Model 3: ARMA(2,1) AIC", arma_mod40.aic, "BIC", arma_mod40.bic, " HQIC", arma_mod40.hqic

print "Model 4: ARMA(2,3) AIC", arma_mod50.aic, " BIC", arma_mod50.bic, " HQIC", arma_mod50.hqic

print "Model 5: ARIMA(3,0,2) AIC", arima_mod1.aic, " BIC", arima_mod1.bic, " HQIC", arima_mod1.hqic

print "Model 6: ARIMA(2,0,3) AIC", arima_mod2.aic, " BIC", arima_mod2.bic, " HQIC", arima_mod2.hqic

In [88]:

print "Metrics for Model 1 ARMA(2,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots20)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots20),"MAE"

print "Metrics for Model 2 ARMA(3,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots30)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots30),"MAE"

print "Metrics for Model 3 ARMA(2,1): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots40)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots40),"MAE"

print "Metrics for Model 4 ARMA(2,3): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots50)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots50),"MAE"

print "Metrics for Model 5 ARIMA(3,0,2): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots1)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots1),"MAE"

print "Metrics for Model 6 ARIMA(2,0,3): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots2)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots2),"MAE"

Analysis

Clearly Model 5 minimizes (aic, bic, hqic). However, Model 1 has the smallest MFE and MAE. In terms of consistency, Model 2 minimizes AIC, BIC, HQIC, MFE and MAE. Also, ARIMA(3,0,2) has the lowest AIC, BIC and HQIC values, though it slightly overfits. Notice that ARIMA(2,0,3) and ARMA(2,3) are the same. Why?

Conclusion

Based on the analysis, I would be conservative and choose Model 1, ARMA(2,0), above the other models.

More Experimentation

Now lets build a few model models for comparison. Note we will renumber the models as well.

In [89]:

arma_mod10 = sm.tsa.ARMA(dta, (1,0)).fit()

arma_mod20 = sm.tsa.ARMA(dta, (2,0)).fit()

arma_mod30 = sm.tsa.ARMA(dta, (3,0)).fit()

arma_mod40 = sm.tsa.ARMA(dta, (2,1)).fit()

arma_mod50 = sm.tsa.ARMA(dta, (2,3)).fit()

arima_mod1 = sm.tsa.ARIMA(dta, (3,0,2)).fit()

arima_mod2 = sm.tsa.ARIMA(dta, (2,0,2)).fit()

arima_mod3 = sm.tsa.ARIMA(dta, (1,0,0)).fit()

arima_mod4 = sm.tsa.ARIMA(dta, (0,1,0)).fit()

arima_mod5 = sm.tsa.ARIMA(dta, (0,0,1)).fit()

arima_mod6 = sm.tsa.ARIMA(dta, (1,1,0)).fit()

arima_mod7 = sm.tsa.ARIMA(dta, (0,1,1)).fit()

arima_mod8 = sm.tsa.ARIMA(dta, (1,1,1)).fit()

arima_mod9 = sm.tsa.ARIMA(dta, (3,0,3)).fit()

arima_mod10= sm.tsa.ARIMA(dta, (1,0,6)).fit()

arima_mod11= sm.tsa.ARIMA(dta, (1,0,3)).fit()

We calculate AIC, BIC, and HQIC.

In [90]:

print "Model 01: ARMA(1,0) AIC", arma_mod20.aic, " BIC", arma_mod20.bic, " HQIC", arma_mod20.hqic

print "Model 02: ARMA(2,0) AIC", arma_mod20.aic, " BIC", arma_mod20.bic, " HQIC", arma_mod20.hqic

print "Model 03: ARMA(3,0) AIC", arma_mod30.aic, " BIC", arma_mod30.bic, " HQIC", arma_mod30.hqic

print "Model 04: ARMA(2,1) AIC", arma_mod40.aic, "BIC", arma_mod40.bic, " HQIC", arma_mod40.hqic

print "Model 05: ARMA(2,3) AIC", arma_mod50.aic, " BIC", arma_mod50.bic, " HQIC", arma_mod50.hqic

print "Model 06: ARIMA(3,0,2) AIC", arima_mod1.aic, " BIC", arima_mod1.bic, " HQIC", arima_mod1.hqic

print "Model 07: ARIMA(2,0,2) AIC", arima_mod2.aic, " BIC", arima_mod2.bic, " HQIC", arima_mod2.hqic

print "Model 08: ARIMA(1,0,0) AIC", arima_mod3.aic, " BIC", arima_mod3.bic, " HQIC", arima_mod3.hqic

print "Model 09: ARIMA(0,1,0) AIC", arima_mod4.aic, " BIC", arima_mod4.bic, " HQIC", arima_mod4.hqic

print "Model 10: ARIMA(0,0,1) AIC", arima_mod5.aic, " BIC", arima_mod5.bic, " HQIC", arima_mod5.hqic

print "Model 11: ARIMA(1,1,0) AIC", arima_mod6.aic, " BIC", arima_mod6.bic, " HQIC", arima_mod6.hqic

print "Model 12: ARIMA(0,1,1) AIC", arima_mod7.aic, " BIC", arima_mod7.bic, " HQIC", arima_mod7.hqic

print "Model 13: ARIMA(1,1,1) AIC", arima_mod8.aic, " BIC", arima_mod8.bic, " HQIC", arima_mod8.hqic

print "Model 14: ARIMA(3,0,3) AIC", arima_mod9.aic, " BIC", arima_mod9.bic, " HQIC", arima_mod9.hqic

print "Model 15: ARIMA(1,0,6) AIC", arima_mod10.aic, " BIC", arima_mod10.bic, " HQIC", arima_mod10.hqic

print "Model 16: ARIMA(1,0,3) AIC", arima_mod11.aic, " BIC", arima_mod11.bic, " HQIC", arima_mod11.hqic

Now we calculate predictions for each model.

In [91]:

predict_sunspots10 = arma_mod10.predict('1990', '2012', dynamic=True)

predict_sunspots20 = arma_mod20.predict('1990', '2012', dynamic=True)

predict_sunspots30 = arma_mod30.predict('1990', '2012', dynamic=True)

predict_sunspots40 = arma_mod40.predict('1990', '2012', dynamic=True)

predict_sunspots50 = arma_mod50.predict('1990', '2012', dynamic=True)

predict_sunspots1 = arima_mod1.predict('1990', '2012', dynamic=True)

predict_sunspots2 = arima_mod2.predict('1990', '2012', dynamic=True)

predict_sunspots3 = arima_mod3.predict('1990', '2012', dynamic=True)

predict_sunspots4 = arima_mod4.predict('1990', '2012', dynamic=True)

predict_sunspots5 = arima_mod5.predict('1990', '2012', dynamic=True)

predict_sunspots6 = arima_mod6.predict('1990', '2012', dynamic=True)

predict_sunspots7 = arima_mod7.predict('1990', '2012', dynamic=True)

predict_sunspots8 = arima_mod8.predict('1990', '2012', dynamic=True)

predict_sunspots9 = arima_mod9.predict('1990', '2012', dynamic=True)

predict_sunspots10 = arima_mod10.predict('1990', '2012', dynamic=True)

predict_sunspots11 = arima_mod11.predict('1990', '2012', dynamic=True)

Now we calculate MFE and MAE for each model.

In [92]:

print "Metrics for Model 01 ARMA(1,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots10)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots10),"MAE"

print "Metrics for Model 02 ARMA(2,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots20)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots20),"MAE"

print "Metrics for Model 03 ARMA(3,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots30)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots30),"MAE"

print "Metrics for Model 04 ARMA(2,1): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots40)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots40),"MAE"

print "Metrics for Model 05 ARMA(2,3): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots50)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots50),"MAE"

print "Metrics for Model 06 ARIMA(3,0,2): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots1)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots1),"MAE"

print "Metrics for Model 07 ARIMA(2,0,2): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots2)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots2),"MAE"

print "Metrics for Model 08 ARIMA(1,0,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots3)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots3),"MAE"

print "Metrics for Model 09 ARIMA(0,1,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots4)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots4),"MAE"

print "Metrics for Model 10 ARIMA(0,0,1): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots5)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots5),"MAE"

print "Metrics for Model 11 ARIMA(1,1,0): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots6)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots6),"MAE"

print "Metrics for Model 12 ARIMA(0,1,1): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots7)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots7),"MAE"

print "Metrics for Model 13 ARIMA(1,1,1): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots8)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots8),"MAE"

print "Metrics for Model 14 ARIMA(3,0,3): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots9)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots9),"MAE"

print "Metrics for Model 15 ARIMA(1,0,6): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots10)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots10),"MAE"

print "Metrics for Model 16 ARIMA(1,0,3): ",mean_forecast_err(dta.SUNACTIVITY, predict_sunspots11)," MFE ", mean_absolute_err(dta.SUNACTIVITY, predict_sunspots11),"MAE"

Conclusion

We had assumed from our preliminary data analysis that the model would have at least 2 autoregression terms. So, we will first examine and compare the models ARMA(2,0), ARMA(2,1), ARMA(2,3) and ARIMA(2,0,3)

Model 14 ARIMA(2,0,3) has relatively good values for AIC, BIC, HQIC, and MAE, but not MFE and underfits (MFE = 5.2779 > 4).

Model 02 ARMA(2,0) has the next best MAE and a relatively good BIC, but slightly underfits (MFE = 4.7303 > 4).

Model 01 ARMA(2,1) and ARMA(2,3) are not as good as ARMA(2,0).

However, look at ARMA(1,0). It has the same AIX, BIC, and HQIC, but it minimizes MFE and MAE.

We choose Model 01 ARMA(1,0) as the best model based on these results. However, I would take the best performing model and plot their prediction and compare them.

Now try to build ARNA(3,2) on your own and compare it with the best model.

Authored by:Jeffrey Strickland, Ph.D.

Authored by:Jeffrey Strickland, Ph.D.Jeffrey Strickland, Ph.D., is the Author of “Predictive Analytics Using R” and a Senior Analytics Scientist with Clarity Solution Group. He has performed predictive modeling, simulation and analysis for the Department of Defense, NASA, the Missile Defense Agency, and the Financial and Insurance Industries for over 20 years. Jeff is a Certified Modeling and Simulation professional (CMSP) and an Associate Systems Engineering Professional. He has published nearly 200 blogs on LinkedIn, is also a frequently invited guest speaker and the author of 20 books including:

- Time Series Analysis using Open-Source Tools

- Logistic Regression Inside and Out

- Discrete Event simulation using ExtendSim

- Crime Analysis and Mapping

- Missile Flight Simulation, Second Edition

- Mathematical modeling of Warfare and Combat Phenomenon

- Predictive Modeling and Analytics

- Using Math to Defeat the Enemy

- Verification and Validation for Modeling and Simulation

- Simulation Conceptual Modeling

Thank you!

ReplyDeleteI am exceptionally upbeat to discover this blog.Thanks for making the page ! I am certain that it will be extremely well known and browse useful site to manage your work. It has great and profitable substance which is exceptionally uncommon nowadays.

ReplyDeleteI'm extremely positive to find out this web site. Many thanks to make the actual web page! More than likely which it will likely be well recognized as well as search helpful website to handle your projects try this. It's excellent as well as lucrative material that is extremely unusual these days.

ReplyDeleteGreat blog for statistics students. Here they'll find more interesting time series. Which is interesting for students. Well, I'm working on the online service in which students will learn how to convert handwriting to text? If you wants to avail this offer then check this and get benefit.

ReplyDeleteFor a many days something is not going right with me. I realize this so deeply. This site help me to find out the problem. Now I can solve this problem of my life. Thanks dude for the best and great suggestion. Keep it up.

ReplyDeleteTo get a many days one thing just isn't proceeding proper with me at night. click to read and i understand this kind of thus significantly. This web site aid myself to learn the situation. Today I could fix this challenge regarding playing. Thank you man to find the best and also fantastic advice. Keep writing.

ReplyDeleteAnalysis of time series has been conducted for the removal of the terms for the individuals. All the issues of the series and visitors of the http://www.retype.biz/affordable-and-accurate-typing-services/ have been marked for the individuals. The suggestion is turned for the ascertainment of the goals.

ReplyDelete

ReplyDeleteI feel satisfied to read your blog, you have been delivering a useful & unique information to our vision.keep blogging.

Regards,

Digital Marketing Training in Chennai

Digital Marketing Course in Chennai

RPA Training in Chennai

Ethical Hacking Course in Chennai

Blue Prism Training in Chennai

Digital Marketing Training in Porur

Digital Marketing Training in Velachery

How to login to a real casino site – Lucky Club

ReplyDelete› how-to-login-to-a-real- › how-to-login-to-a-real- Casino Site. In order to access your account, click on the 'My Account' button. Click on luckyclub the 'Register Now' button and follow instructions to

بهینه سازی یک وب سایت برای سئو انگلیسی شامل روش های استراتژیک برای افزایش موثر ترافیک است. اول از همه، ترکیب کلمات کلیدی مرتبط در سراسر وب سایت ضروری است. با انجام تحقیقات دقیق کلمات کلیدی، می توانید عباراتی را که مخاطبان هدف شما جستجو می کنند شناسایی کنید و به طور طبیعی آنها را در محتوا، متا تگ ها و هدرهای خود ادغام کنید. محتوای جذاب و با کیفیت بالا که در عین رعایت اصول سئو، ارزشی را برای کاربران به ارمغان می آورد، کلید بهبود رتبه بندی موتورهای جستجو است.

ReplyDelete